tax payment forgiveness program

The qualification requirements are. First-time penalty abatement is another one-time forgiveness program that allows the IRS to waive all fines and penalties you owe.

Some States Could Tax Cancelled Student Loan Debt Kiplinger

State Tax Forgiveness.

. IRS debt forgiveness is for those with a debt of 50000 or less. Tax forgiveness is a credit that. Tax debt forgiveness is available if your solo income is.

For example in Pennsylvania a single. You must pay any. IRS Tax Forgiveness Program.

The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. State Tax Forgiveness. Wondering if tax forgiveness is real.

States also offer tax forgiveness based on personal income standards. What Is Tax Forgiveness. Submit an initial payment of 20 of the total offer amount with your application.

The OIC or Deal in Compromise is just one of the manner ins which the internal revenue service has created as a means to collect on the amount. Student Loan Forgiveness Schedule Dates. Furthermore you cant have more than 100000 in income if you are filing alone and.

The IRS can continue to collect from your paycheck until youve paid back your tax bill or made other arrangements to pay your debt. WASHINGTON The Internal Revenue Service recently issued guidance addressing improper forgiveness of a Paycheck Protection Program. Child Tax Credit The 2021 Child Tax Credit.

However if we have a valid reason for not making the payment there are a few IRS tax debt forgiveness programs. No tax debts for the. The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more manageable way.

Here are some of the important dates to keep in mind with regard to the student loan forgiveness process. What Is The Debt Forgiveness Program. This is a tax debt forgiveness for.

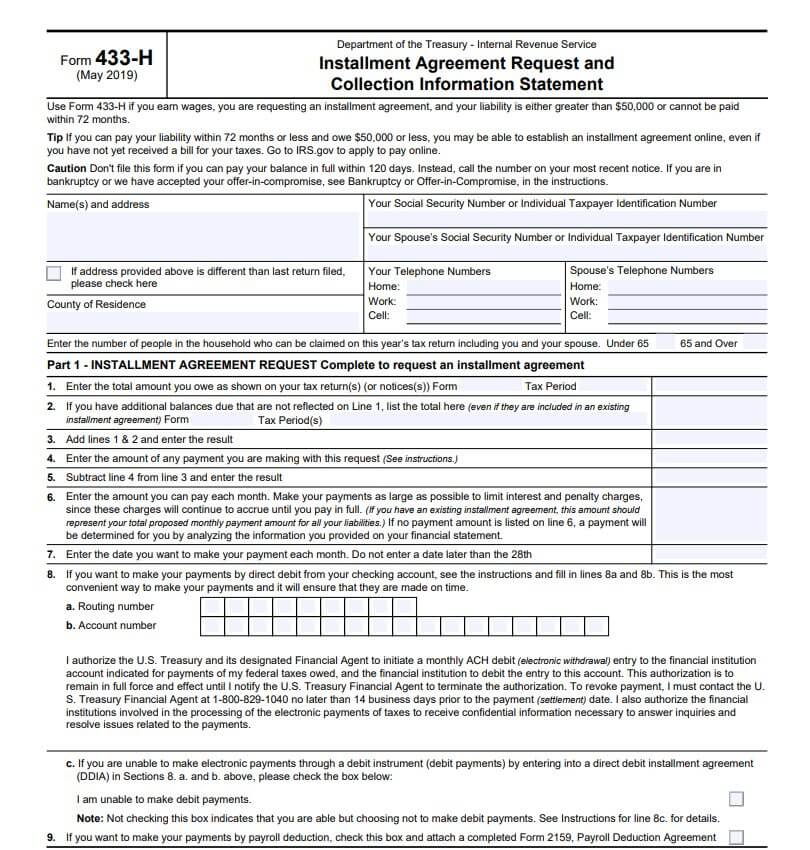

Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application. Agree to a direct payment installment forgiveness. Some forms of tax debt.

The Mayors Office and Department of Finance is offering a late fee. IRS Tax Debt Forgiveness Program. Although its rare for the IRS to fully forgive your tax balance it does offer various ways to reduce or eliminate.

Who Is Eligible For The Irs Debt Forgiveness Program. May 15 2020. Your tax balance needs to be below 50000 for you to be able to qualify for a tax forgiveness program.

If we accept your offer youll receive written confirmation. Agree to a direct payment installment forgiveness. IR-2022-162 September 21 2022.

These standards vary from state to state. Ad The IRS Has a Forgiveness Plan. Lump Sum Cash.

The IRS Fresh Start Program allows for tax forgiveness credits against your earned income to help reduce the overall amount of money you owe in taxes every year. Were offering tax help for individuals families businesses tax-exempt organizations and others including health plans affected by coronavirus.

Irs Tax Debt Forgiveness Program Irs Tax Relief Programs

Understanding The Tax Implications Of Student Debt Forgiveness Urban Institute

Irs Tax Payment Plans Installments Or Offer In Compromise

Irs Installment Agreement Guide On Irs Payment Plans Supermoney

These States Could Tax Your Student Loan Forgiveness Time

Federal Student Loan Forgiveness Indiana Will Tax Canceled Debt

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Irs Tax Debt Relief Forgiveness On Taxes

Minnesota Legislators Are Considering Lifting Taxes On Federal Student Debt Relief

Get A Fresh Start The Irs Tax Debt Forgiveness Program

Get Student Loan Forgiveness If You Paid During Pandemic Pause Abc10 Com

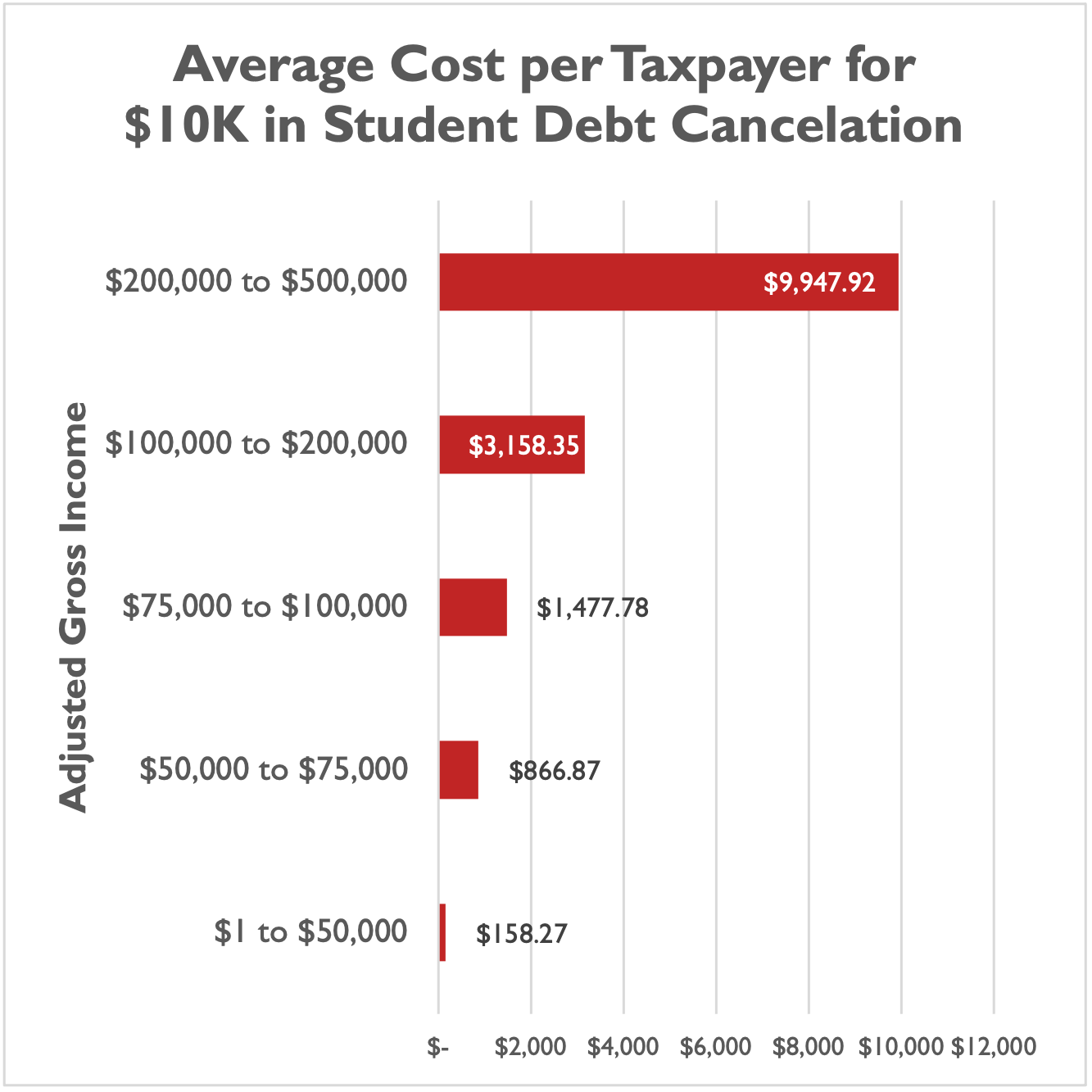

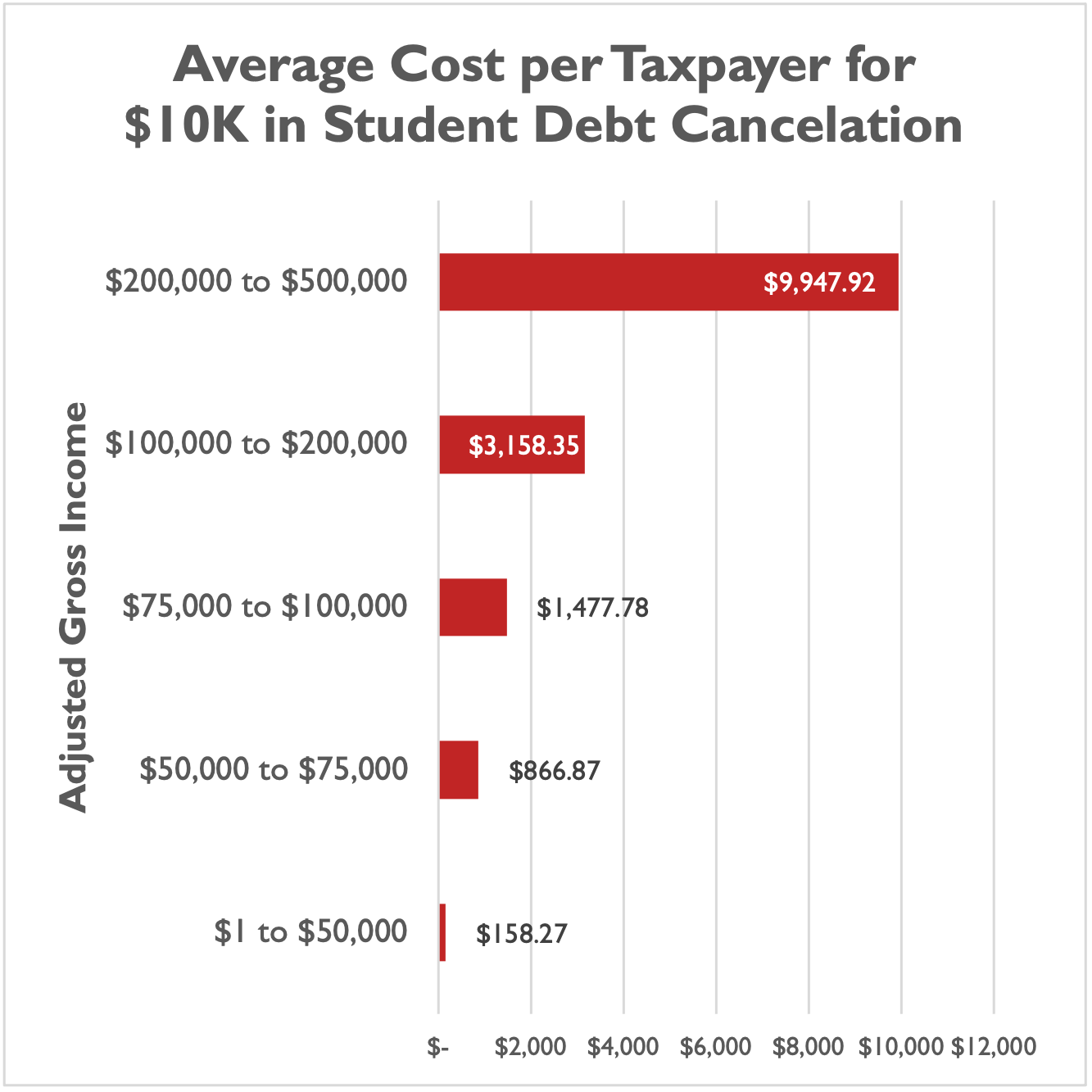

Cost Of Student Debt Cancelation Could Average 2 000 Per Taxpayer Foundation National Taxpayers Union

Tax Free Student Loan Forgiveness Is Part Of The Latest Covid 19 Relief Bill Hbla

Irs Debt Forgiveness Chandler Az New Freedom Tax Relief Llc

Income Driven Repayment Options

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune